BUY NOW, SAVE BIG.

Fuel Payback + Year-End Tax Incentives = Huge Savings

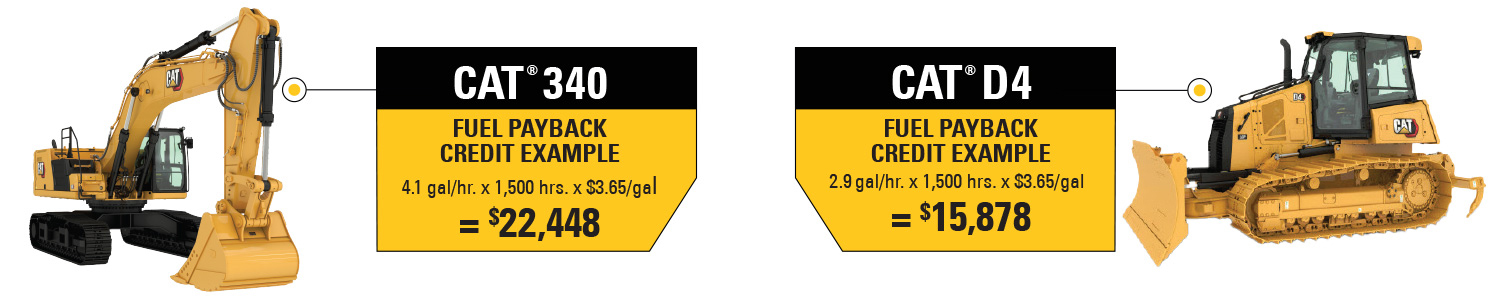

Our Fuel Payback Credit delivers an immediate return on your new machine investment. Combine it with 2024 year-end tax incentives – and one thing is clear: now is definitely the time to own a new Cat® machine. Buy a qualifying new Cat Dozer, Excavator, Motor Grader, Soil Compactor, Track Loader, or Wheel Loader and get account credit for the first 1,500 hours or 24 months of fuel (whichever comes first). See below for examples of how the fuel payback credit works.

Interested in financing instead of utilizing the fuel payback? Contact our team using the button below to find out about the many options available to you.

Whatever purchase option you choose, you’ll also receive a Cat Customer Value Agreement (CVA) with your machine, giving you peace of mind on your equipment protection, maintenance, and connectivity needs.

Credit amounts will vary based on machine model and utilization.

Eligible Models

| MEDIUM EXCAVATORS | LARGE EXCAVATORS | MOTOR GRADERS | MEDIUM WHEEL LOADERS | TRACK LOADERS | MEDIUM DOZERS | WHEELED EXCAVATORS |

|---|---|---|---|---|---|---|

| 320 | 336 GC | 120 | 950 | 953 | D4 | M314 |

| 320 GC | 336-07 | 120 AWD | 950M | 963 | D5 | M315 |

| 323 | 336-08 | 120 GC | 950 GC | 973K | D6 | M316 |

| 325 | 340-08 | 120 GC AWD | 962 | D6 XE | M318 | |

| 326 | 340 LRE | 140 Lever | 962M | M319 | ||

| 330 | 340 SB | 140 Lever AWD | 966 GC | M320 | ||

| 330 GC | 340 UHD | 140 GC | 966 | M322 | ||

| 335 | 349-07 | 140 GC AWD | 966 XE | |||

| 538 GF | 350-06 | 140 Joystick | 972 | |||

| 538 LL | 352-07 | 140 Joystick AWD | 972 XE | |||

| 548 GF | 352-08 FG | 150 | 980 | |||

| 548 LL | 352-08 VG | 150 AWD | 980 XE | |||

| 558 GF | 352 LRE | 160 | 982 | |||

| 558 LL | 352 UHD | 160 AWD | 982 XE | |||

| 568 GF | ||||||

| 568 LL |

*Offer valid through 12/31/24 on select new Cat equipment. Machine must deliver on or before expiration date. Additional terms and conditions apply. Visit www.CarterMachinery.com/specials/fuel-payback for more details. **Caterpillar and Carter Machinery do not provide tax advice and this promotion should not be considered tax or legal advice. Customers should always consult their legal, tax or accounting advisor before making decisions. Section 179 allows taxpayers to expense up to $1,220,000 in new and used eligible equipment purchases made in 2024 not exceeding $3,050,000. 60% bonus depreciation is reserved for new and used equipment purchases.